Greek Startups Funding Rounds & Exits

Since starting Marathon Venture Capital in 2017, we have been focusing on mapping the Greek startup market and tracking every technology company with a Greek founder that raised an investment round or completed an acquisition or public listing. We published the first such report in early 2019 and continued sharing our findings in 2020, 2021, and 2022.

Today, for the first time in our market, we are releasing an interactive dashboard with funding rounds and acquisition data updated as soon as these become publicly announced. The dashboard provides aggregated views (number of funding rounds, total funding amounts, funding per stage, number of exits, etc.) – including Year-to-Date (YTD) figures – and a feed of the latest events (recent funding rounds and exits). This offers a great way to unveil trends as they unfold instead of only looking back and reporting on the year that ended.

Head on over to our Greek startups funding rounds & exits dashboard to have a look.

Our inputs include a fusion of publicly available sources, such as Crunchbase and media publications. We acknowledge there may be several cases we did not manage to track and welcome further suggestions.

Key highlights

2022 was a challenging year for tech globally. Public tech stocks had a meltdown, and private markets were also impacted as the valuations are indexed to public market companies, especially for growth-stage companies. Global venture funding in 2022 reached $445 billion — marking a 35% decline year over year from the $681 billion invested in 2021.

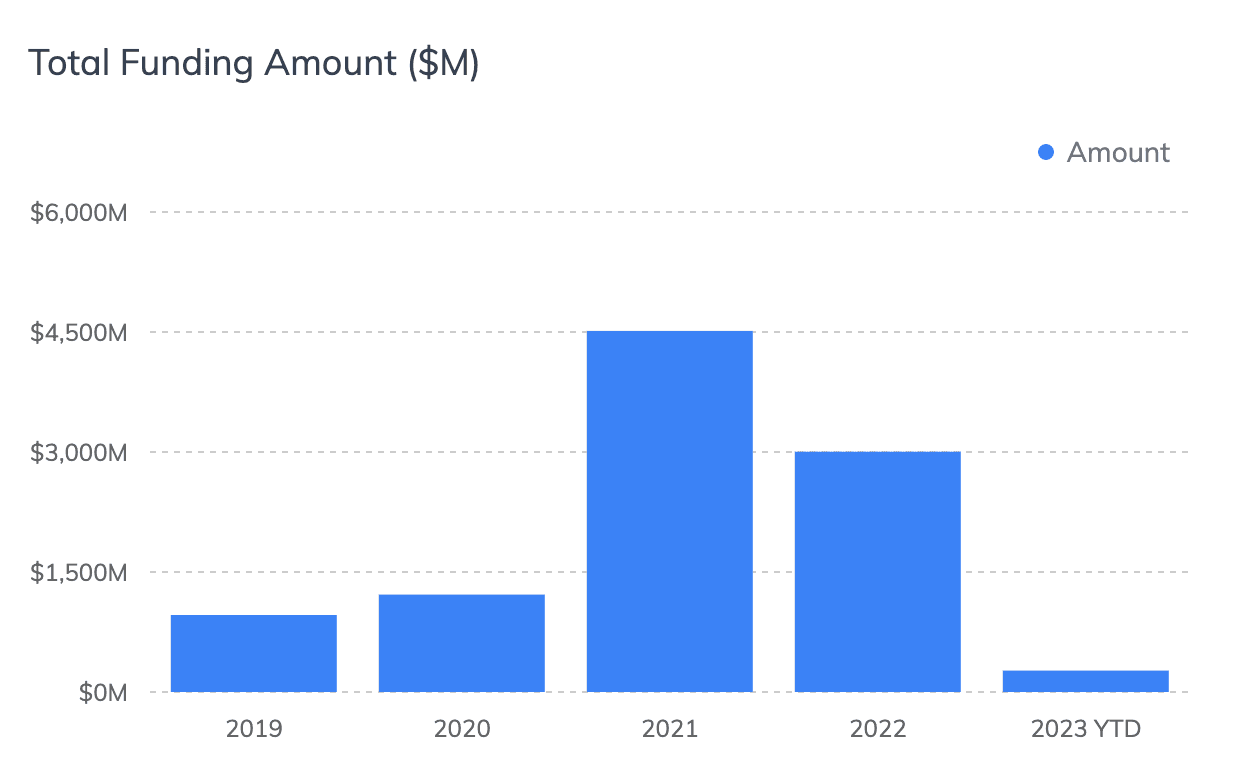

Despite the slower funding environment in 2022, Greek-founded startups raised $3 billion, $1.8 billion more than in 2020. It ought to be said: this is the largest amount ever, apart from 2021, which we consider an outlier year – and compared to 2021, there’s a 33% decline, which is on par with that of the global venture funding.

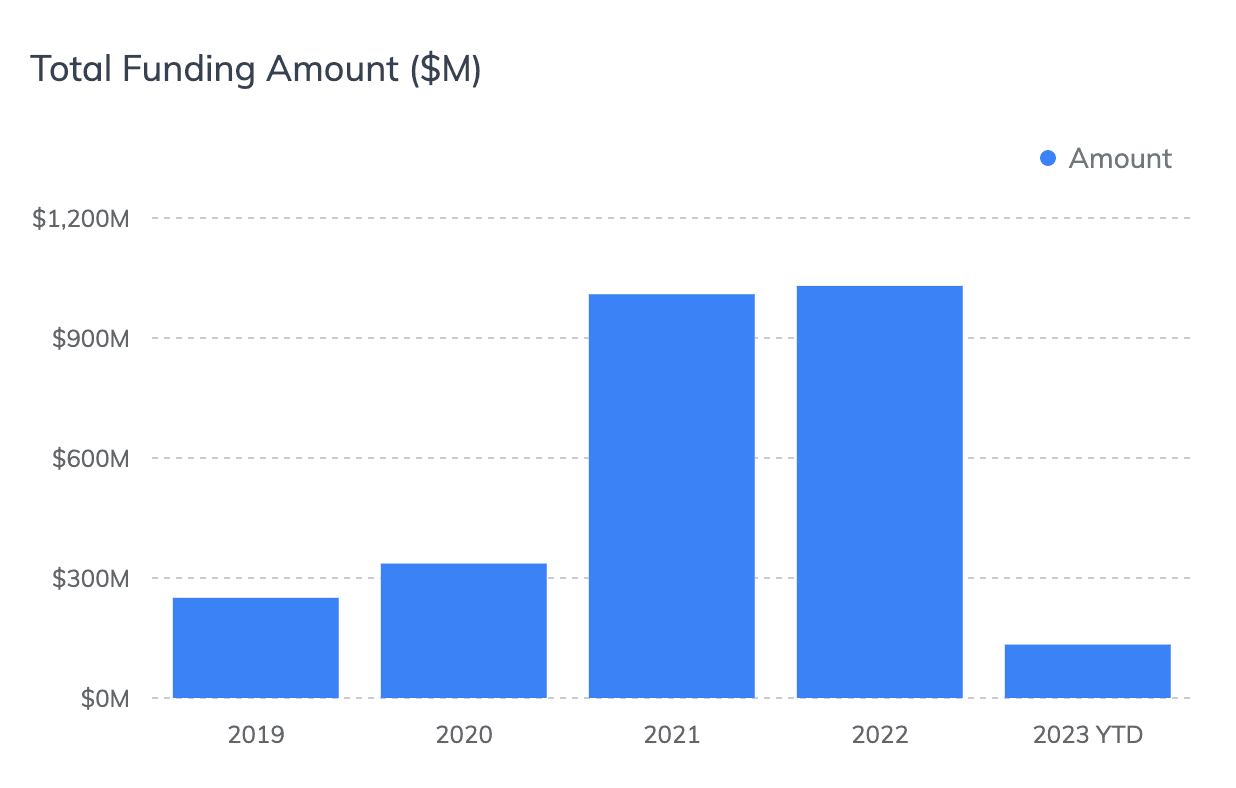

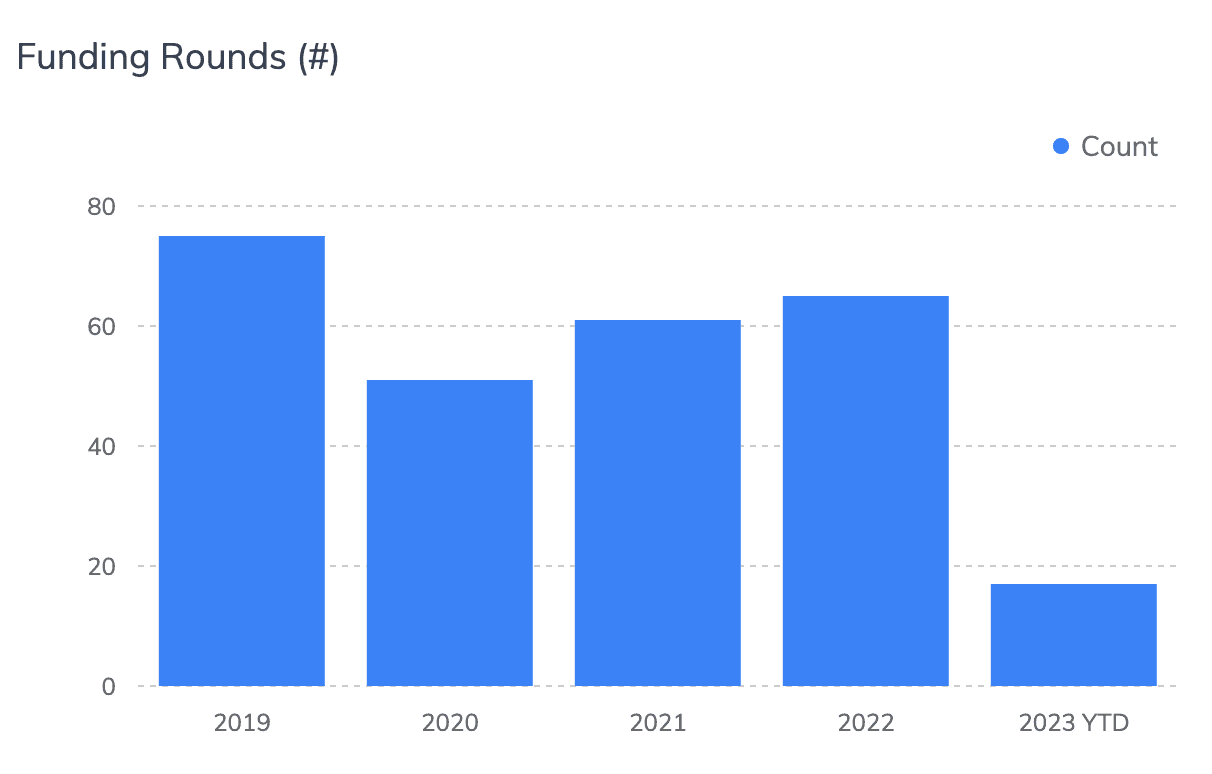

Amidst 2022’s tough macroeconomic environment, startups with operations in Greece showed remarkable resilience. The number of funding rounds and the total amount raised were higher than the year before, making our market a positive outlier compared to most tech ecosystems globally. 65 startups raised a funding round (61 in 2021), totalling over $1.03 billion ($1 billion in 2021). We noticed significant activity taking place in Seed with 41 rounds, including Pre-Seed and Seed rounds, and this presents an uptick compared to both 2020 (32) and 2021 (30). This is great news for our industry, indicating that more capital is directed towards early-stage startups, helping propel their growth.

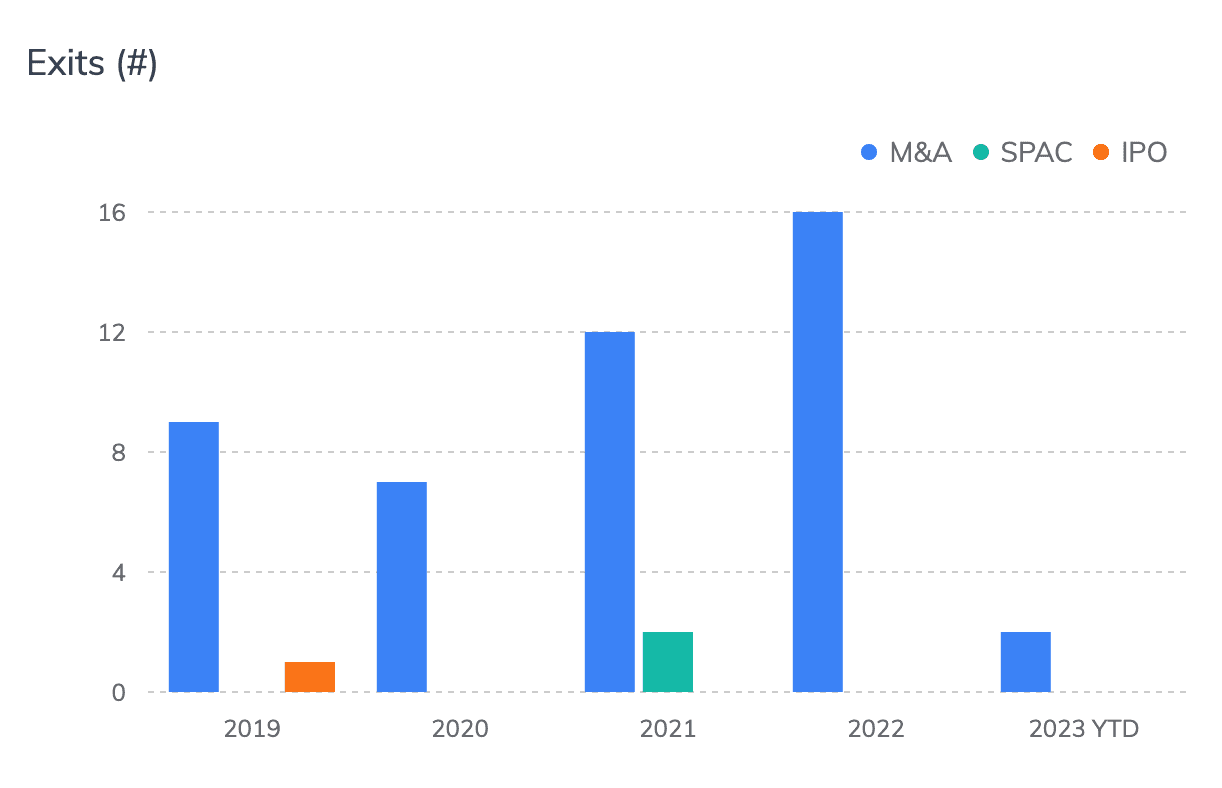

Meanwhile, startups with operations in Greece surpassed previous records, with 16 acquisitions in 2022, while the equivalent number in 2021 was 12.

2023 has started strong as Greek-founded startups have already raised 26 rounds and almost $300 million from 43 venture capital funds, and two acquisitions have occurred. You can find further information on the dashboard here.

At Marathon, we have been on a mission to help Greek founders create world-class technology companies. Seeing our network taking shape and reaching new heights has been fascinating. Still, it is early days for Greek-founded startups, and we look forward to what's coming next!