The Greek Startup Industry: Investments and Exits, 2010-2020

First and foremost, we are network builders. Others have been doing the same with Stanford graduates, Paypal employees, or Israeli founders. We bring together Greeks, working in technology, no matter where they are, and we are thrilled about the ubiquity and underlying value of this network.

This is how we introduced Marathon Venture Capital in 2017. Today, a few months into our second fund, we are providing evidence that the network of Greek entrepreneurs and technologists is consistently growing and its underlying value is increasingly materializing. By various accounts, the Greek startup industry has now reached an inflection point, triggering a virtuous circle.

This is a publication documenting the industry’s evolution, focusing on the facts. Such include, among others, investment figures and related statistics. We have made an effort to track every single technology company with a Greek founder –our definition of a Greek startup– that raised an investment round and/or completed an acquisition or IPO since 2010.

Our inputs include publicly available sources such as Crunchbase and media publications, together with proprietary Marathon data. While there most probably exist more cases we did not manage to capture, we believe this is the most extensive research on Greek startups published to date.

For the first time, we are also sharing a full list of such publicly available data in spreadsheet format. We hope that opening up such a resource to our community will spark further interest and create more opportunities in the space.

Overview

Our research identified 608 Greek startups that raised a total of $6 billions in 927 investment rounds by 790 investors between 2010 and 2020. Moreover, a total of 84 acquisitions and 8 IPOs took place during this period.

The total investment size per year grew 23x from a mere $51m in 2010 to over $1.1b in 2020. More specifically, last year Greek startups raised more money than ever.

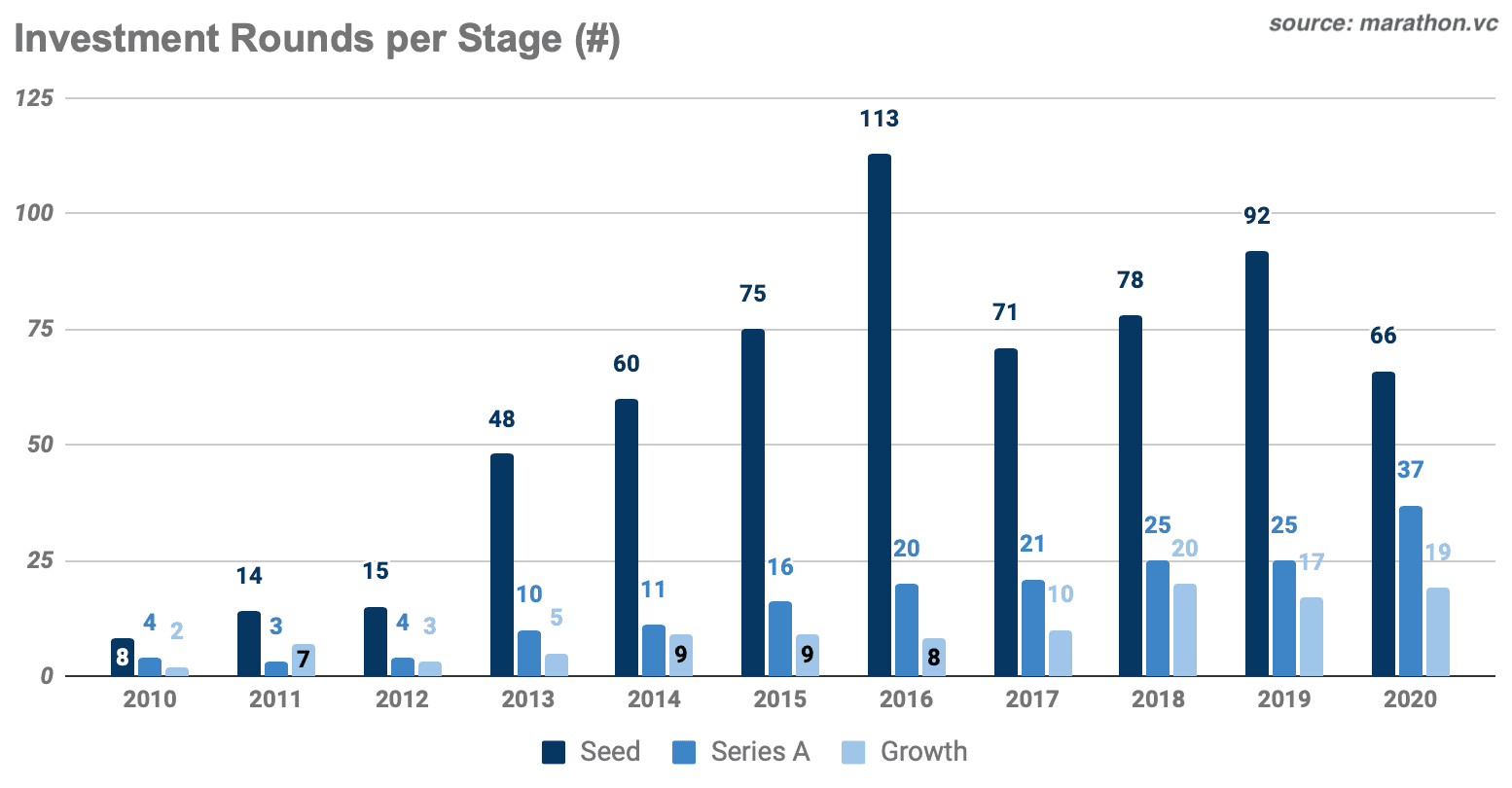

The number of investment rounds per year has grown 9x from 2010 to 2020. There were 14 investments reported in 2010, while this number reached 124 in 2020, with a peak of 141 in 2016. As you can see in the chart above, there is a steadily high number of funding rounds occurring over the past few years.

Stages

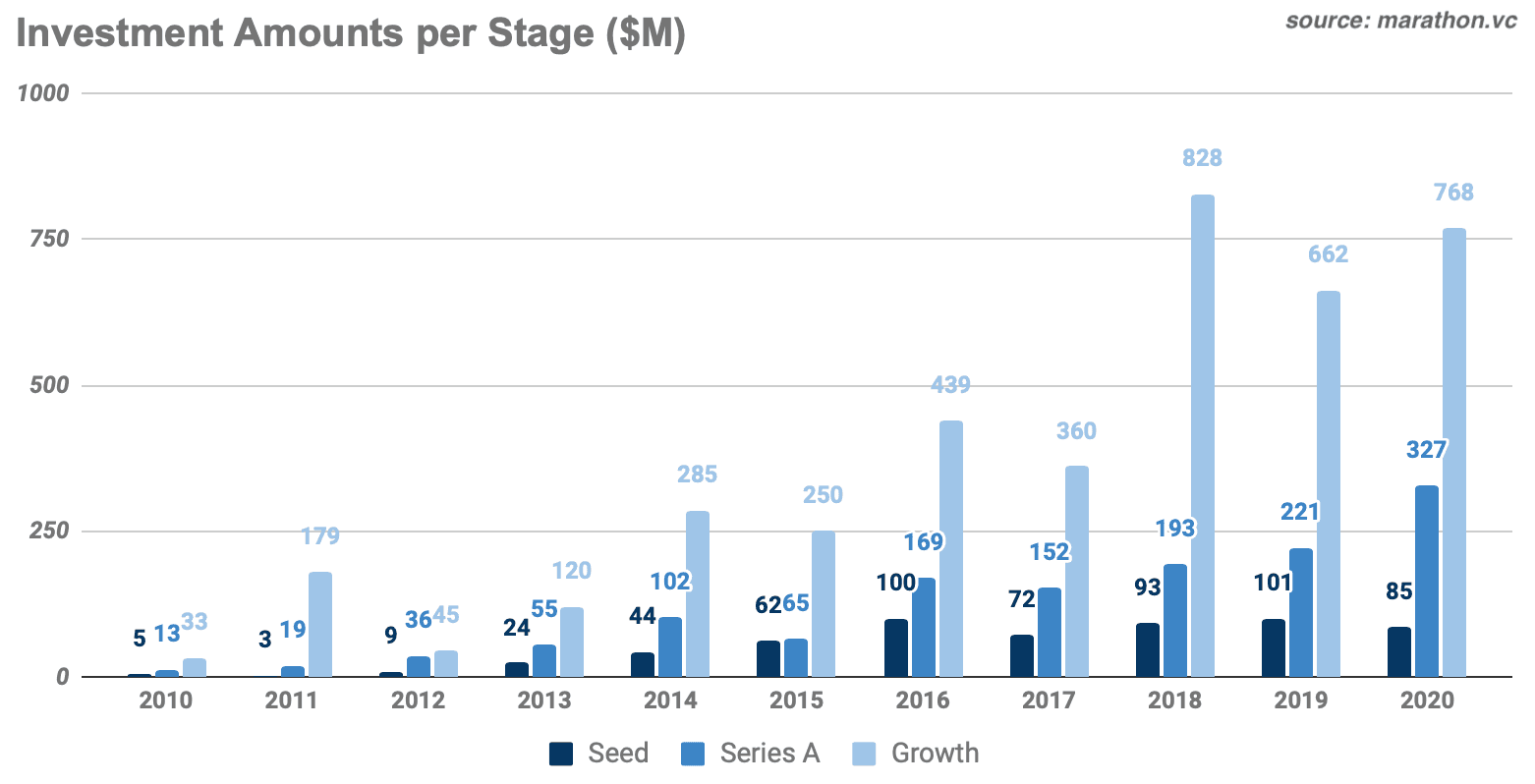

For the purposes of the study, we classified each investment round into Seed, Series A and Growth (Series B, C, etc.) stages. In 2020, Seed reached $85m, Series A $327m and Growth $768m.

Growth rounds have been capturing the greatest part of investment volume throughout the years, showing a significant increase from 2018 onwards and particularly in 2020, following the global market trend. Series A investment amounts have also been growing steadily during the past few years, highlighting a consistently increasing quality in recent cohorts.

In the past three years, the total amount raised by Greek startups has reached $1b/year, marking a record high in 2020 with over $1.1b. At the same time, more and more funding is directed towards later-stage companies (Series A and Growth). We consider this to be a solid sign our industry is rapidly maturing.

With regard to Seed and after a relatively slow first half of 2020, we expect the growth trend to fully resume, as existing funds are renewing their commitments and new players enter the market.

Greece

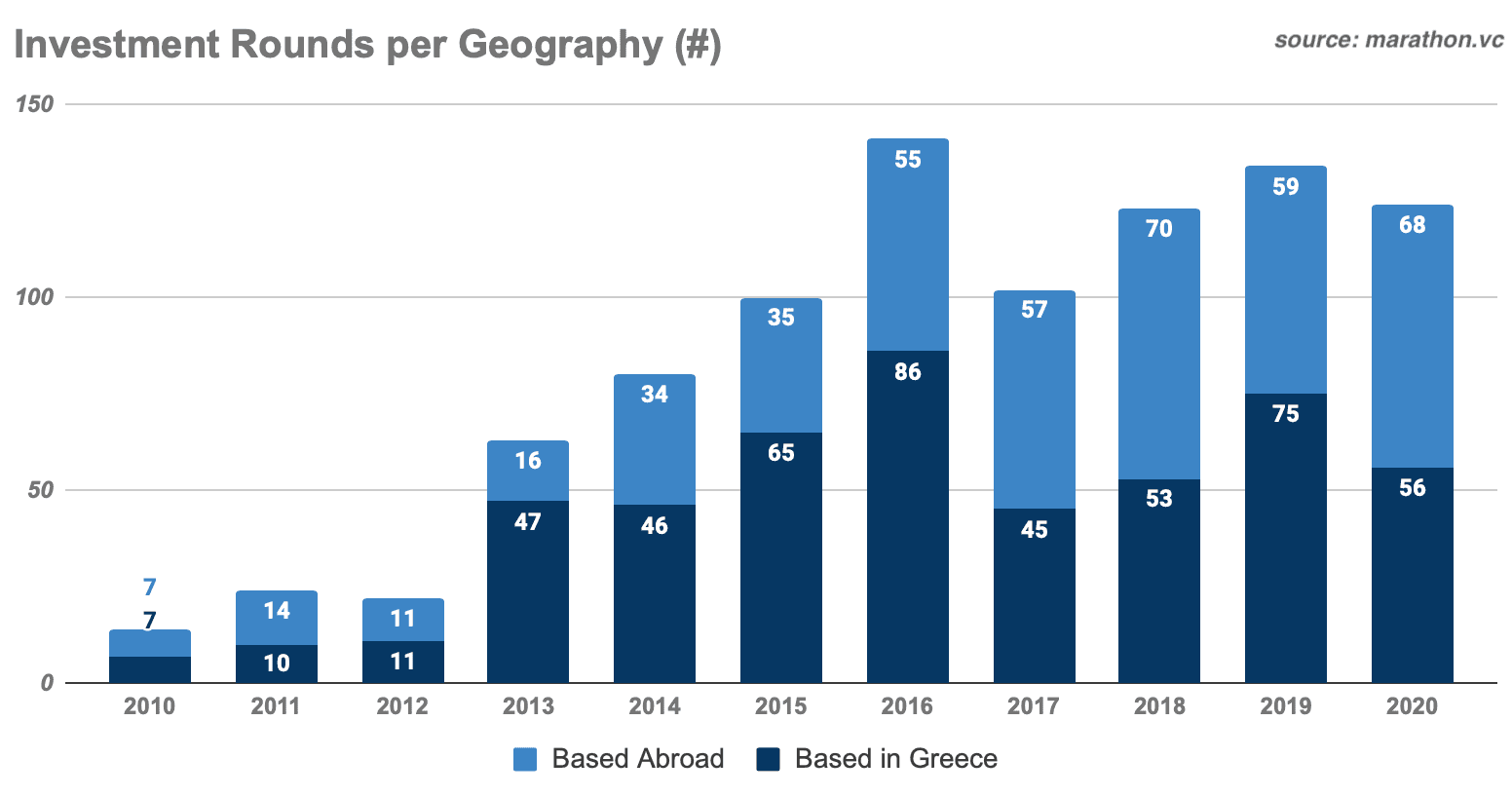

Between 2010 and 2020, 501 out of the 927 rounds (54% of total) were invested in startups maintaining a presence in Greece.

Total investment amounts have been increasing fast, both inside and outside of Greece. Overall, companies based in other geographies have raised 77% of the total from 2010 to 2020. Still, startups maintaining operations in Greece have raised a total of $1.34b within the period, getting from $10m raised in 2010 to $386m in 2020, a 39x increase.

During the past three years, over $900m have been invested in startups with significant operations in Greece.

This level of commitment serves as a testament to the growing opportunity the investment community sees in the Greek startup industry. It is also important to highlight that such investment volume has grown 3x compared to the previous three years, and more than 7x compared to the three years before that. We expect such growth to continue at a similar pace going forward.

And beyond

Startups are not limited to geographies and, by extension, Greek startups are not limited to Greece. Greek founders are building startups around the world and 249 out of 608 startups that raised investment in the period under study did not have a presence in Greece as of the end of 2020.

Here is a detailed breakdown of the most popular geographies.

Startups with an established presence in Greece continue to maintain a growing part of their operations in the country. For most of the companies based abroad without a presence in Greece yet, the majority of founders would be keen to explore such an option in the future. Given the fact that remote work is becoming more prevalent, there are more opportunities for potential expansion in the country and we expect such a trend to extend further going forward.

Investors

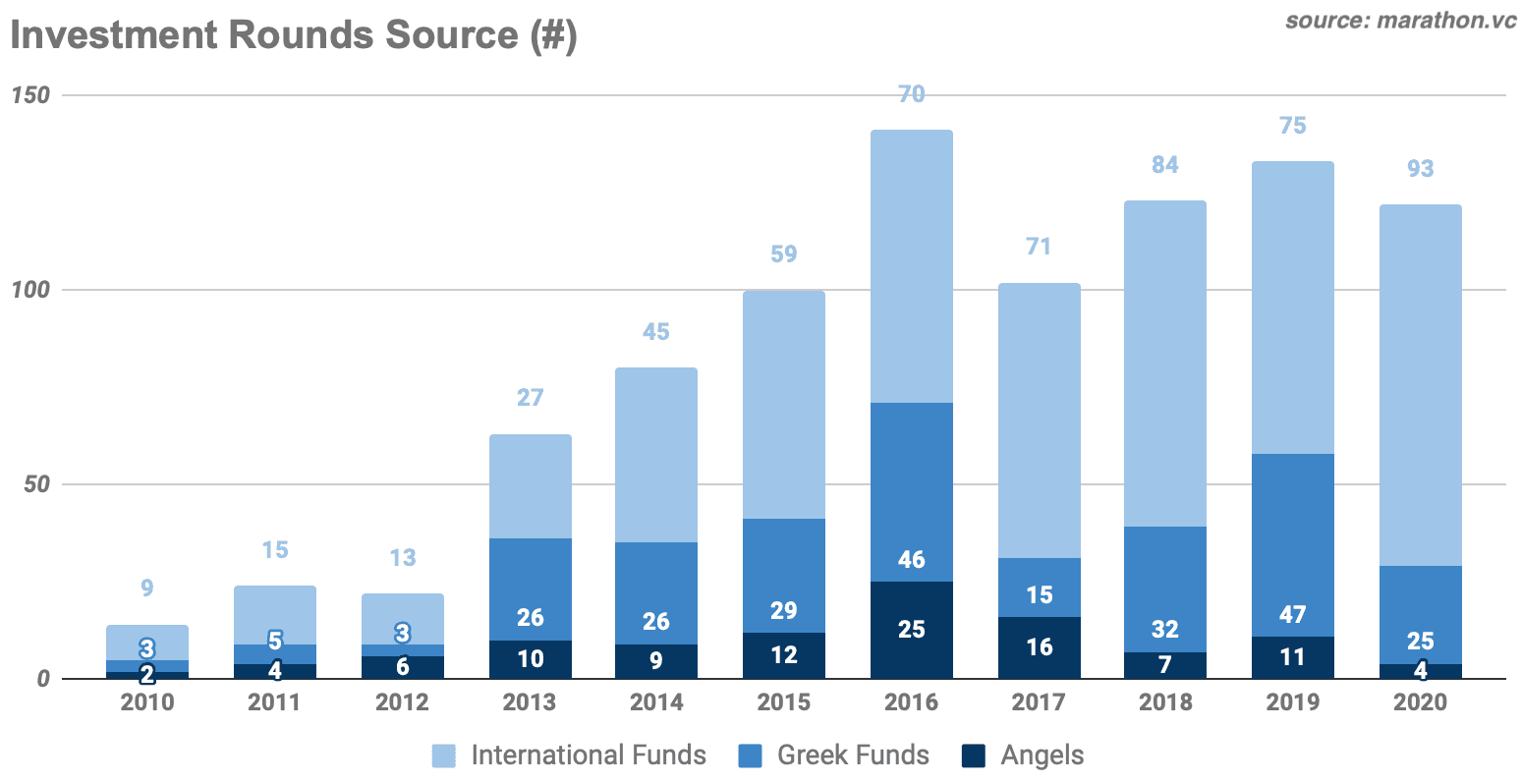

The following graph describes the evolution in the number of rounds led by international versus Greek funds versus angel investors. Please note each round is assigned to its lead investor, while typically there are more participants.

It is exciting to see more and more institutional investors based around the world leading investment rounds in Greek startups. They have led 561 (61%) of the total number of rounds, whereas Greek funds have led 257 (28%) and angel investors 106 (11%). The level of activity by international funds has been increasing consistently, while, as mentioned above, we expect the growth in Greek funds’ activity to resume shortly. Also taking into account the fact that most international funds focus on Series A and Growth stage investments, such increasing activity provides further evidence on the acceleration of the Greek startup industry.

It is not just about the numbers, though, but also about the caliber of market participants. The above figure highlights top-tier international funds that have invested in two or more startups in our industry.

The list is remarkable – some of the most prominent venture capital funds in the world are investing in Greek startups.

Acquisitions & IPOs

Acquisitions and IPOs stand as the ultimate proof point regarding the value generated by Greek startups. Typically, these take time to happen; they are a lagging indicator of the underlying progress being made.

Between 2010 and 2020, 84 acquisitions and 8 IPOs of Greek startups have been completed. The number of acquisitions and IPOs grew from 1 in 2010 to 18 in 2019 and 14 in 2020.

During the same period, the total amount of acquisitions has reached $7.52b with a record-high of $2.59b in 2020. The past year, the acquisition amount has been significantly higher especially inside Greece, where the amount surpassed $500m.

The above figure highlights some of the companies that each have already completed one or more acquisitions in our industry.

Greek startups are getting acquired by some of the largest technology companies in the world.

The Greek startup industry is now stronger and more mature than ever before. Investment and acquisition amounts are at an all-time high. Top-tier venture capital funds are increasingly investing and big tech companies are repeatedly acquiring Greek startups. The flywheel effect is real – it is happening!

To further raise awareness and create more opportunities for our industry, today we are taking the extra step to release our research data originating via public sources.

We are making available full data for 556 startups that have Greek founders and have been funded and/or acquired and/or went public since 2010. To ensure consistency, we have only included data currently available on Crunchbase. We include company name, founder name, investors, total investment amount, stage, geography, etc, in a spreadsheet format. To our knowledge, this is the most comprehensive resource available on the topic, and you are welcome to copy, process and make the most out of it.

At Marathon, we have been on a mission to help Greek founders create world-class technology companies. It has been fascinating to see our industry taking shape and reaching new heights. Still, it is early days for Greek startups – more great developments are around the corner and we cannot wait to see the accelerated progress in the years to come. Watch this space!