Greek Startups: Funding Rounds & Exits, 2024

As 2025 kicks off, it's a moment to reflect on a year when investment activity regained its footing. Overall startup funding levels in 2024 edged higher than in 2023 for Greek-founded startups, surpassing $1.3B – a welcome sign of confidence returning to the market after two consecutive years of contraction, with top-tier investors leading rounds and supporting teams.

In a year of limited global liquidity, 2024 saw the largest acquisition of a tech company in Greece ever for $1.2B. BETA CAE's acquisition by Cadence also made the list as one of the largest M&A transactions for tech companies across Europe this year.

Greek-founded startups globally

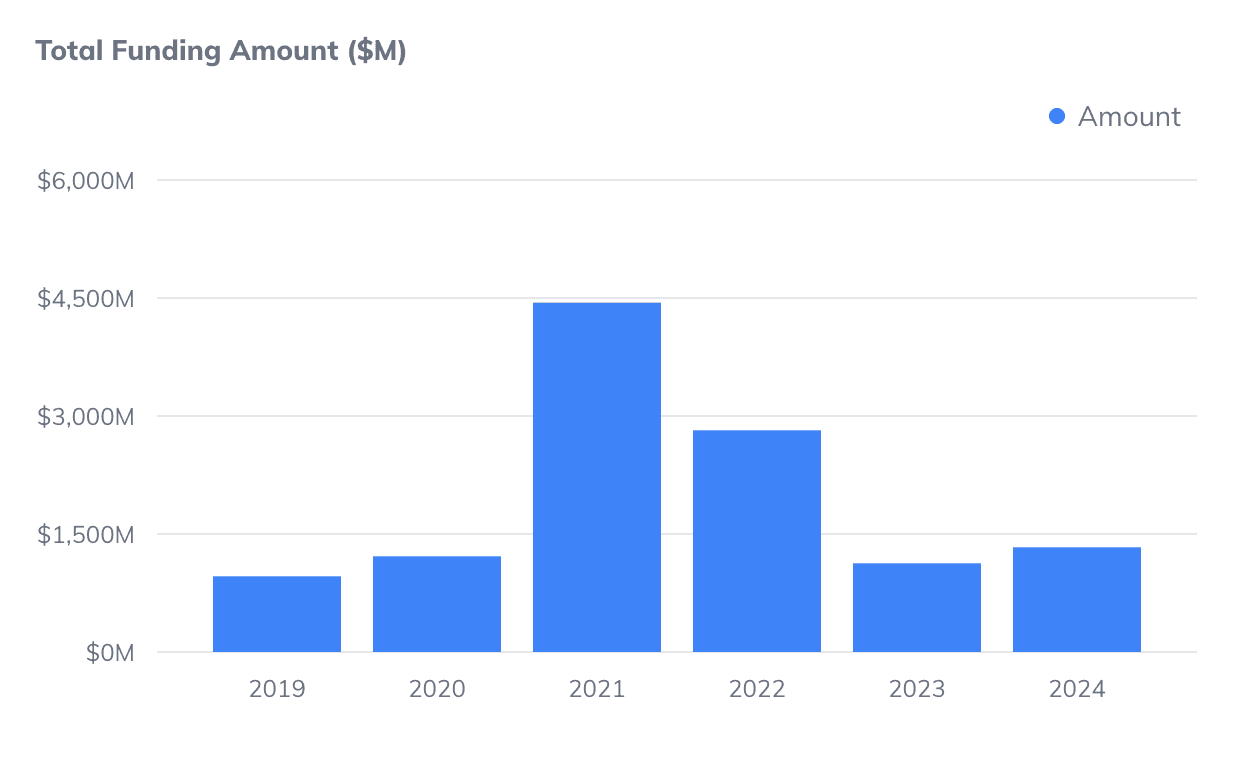

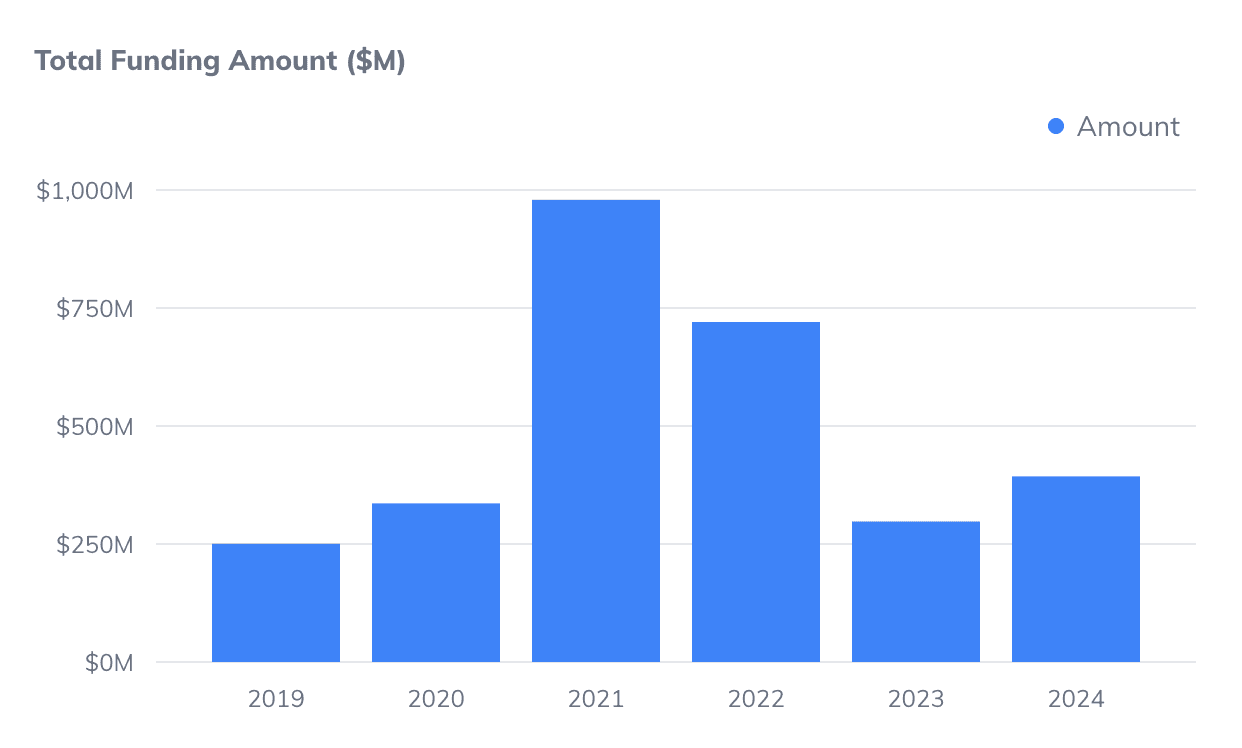

The total funding amount raised by Greek-founded startups worldwide in 2024 reached $1.3B, surpassing the equivalent of 2023 by $200M. Despite the significant drop from the peak of euphoria a couple of years ago, the figure is ascending within its long-term trendlines. For reference, the equivalent was $962M in 2019 and $1.2B in 2020.

It’s exciting to see some of the top investors globally continuing to invest in Greek-founded startups. In 2024, the list included the likes of Sequoia (Reflection AI), Andreessen Horowitz (Kaedim, Pantheon AI, and others), General Catalyst (Dealops), Alibaba (Connectly), NATO Innovation Fund (iCOMAT), Point Nine (BlueLayer), Atomico (Harbor Lab), Eurazeo (Kinvent), and more.

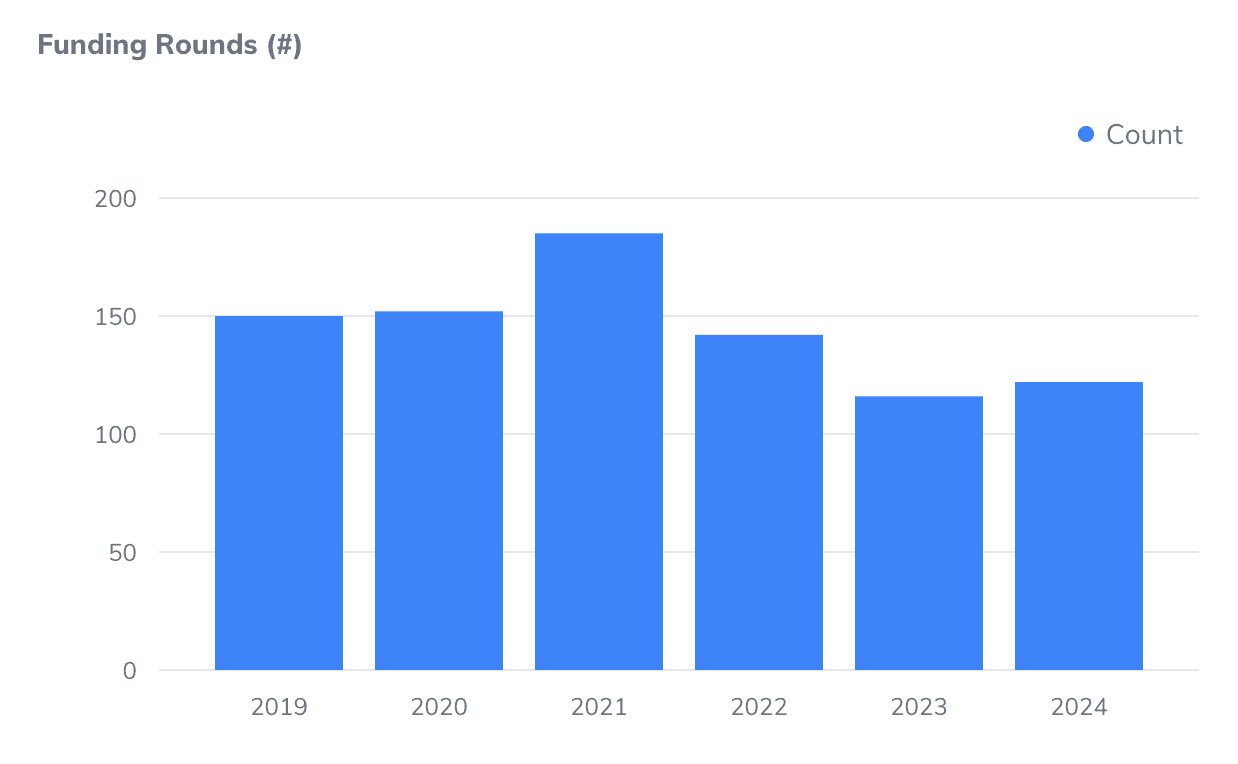

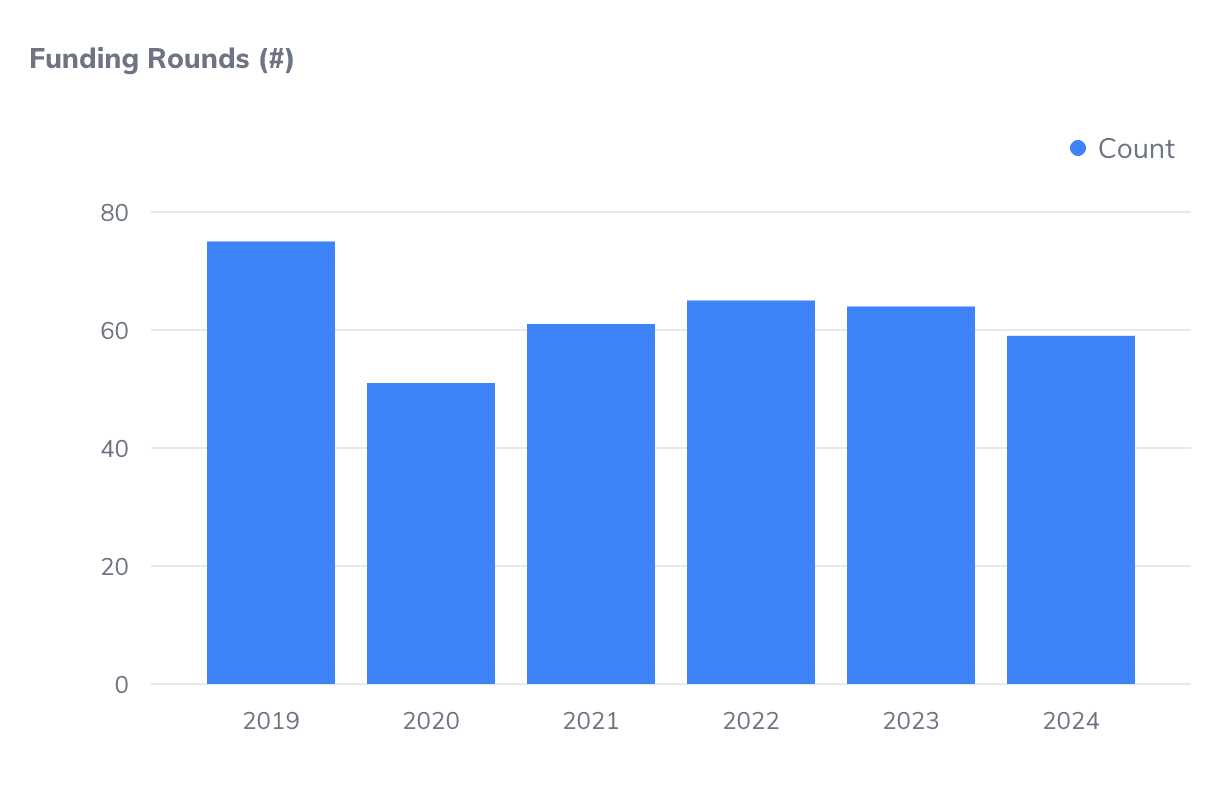

Even though the total funding amount is in a long-term ascending trendline, the number of funding rounds has been relatively flat over the years. Our industry consistently generates about 150 rounds per year.

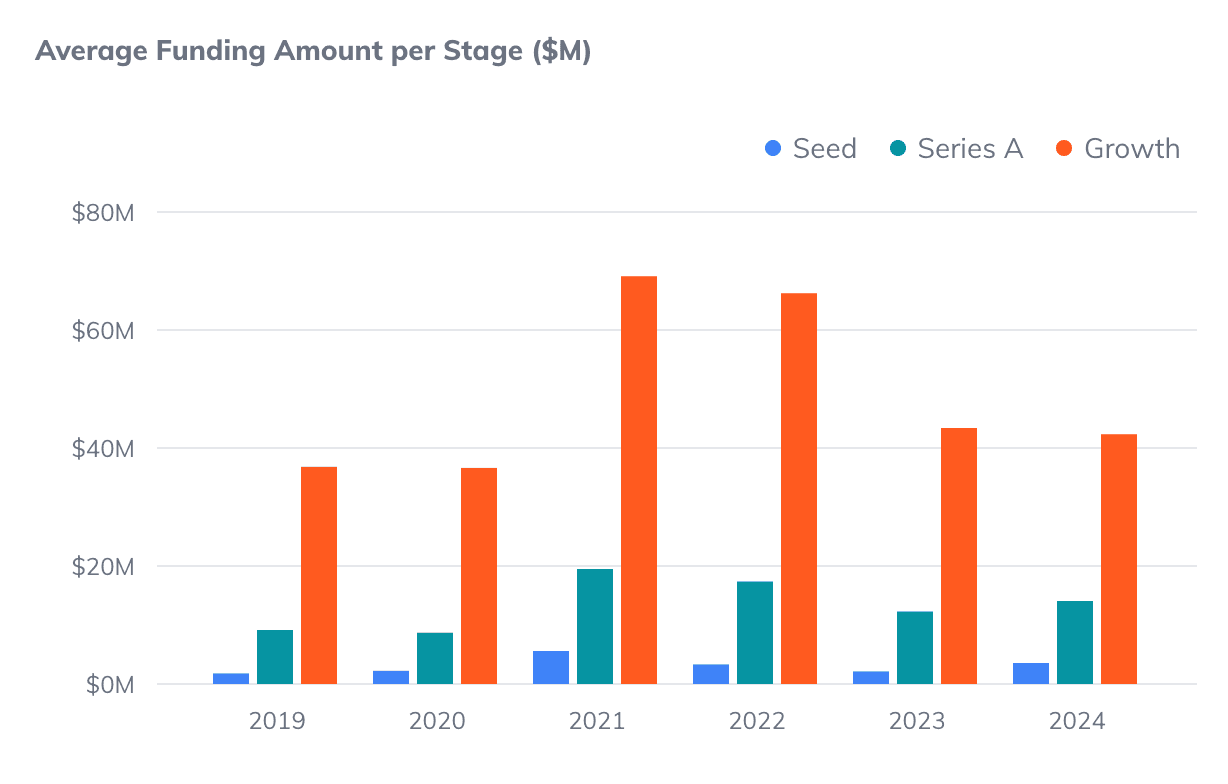

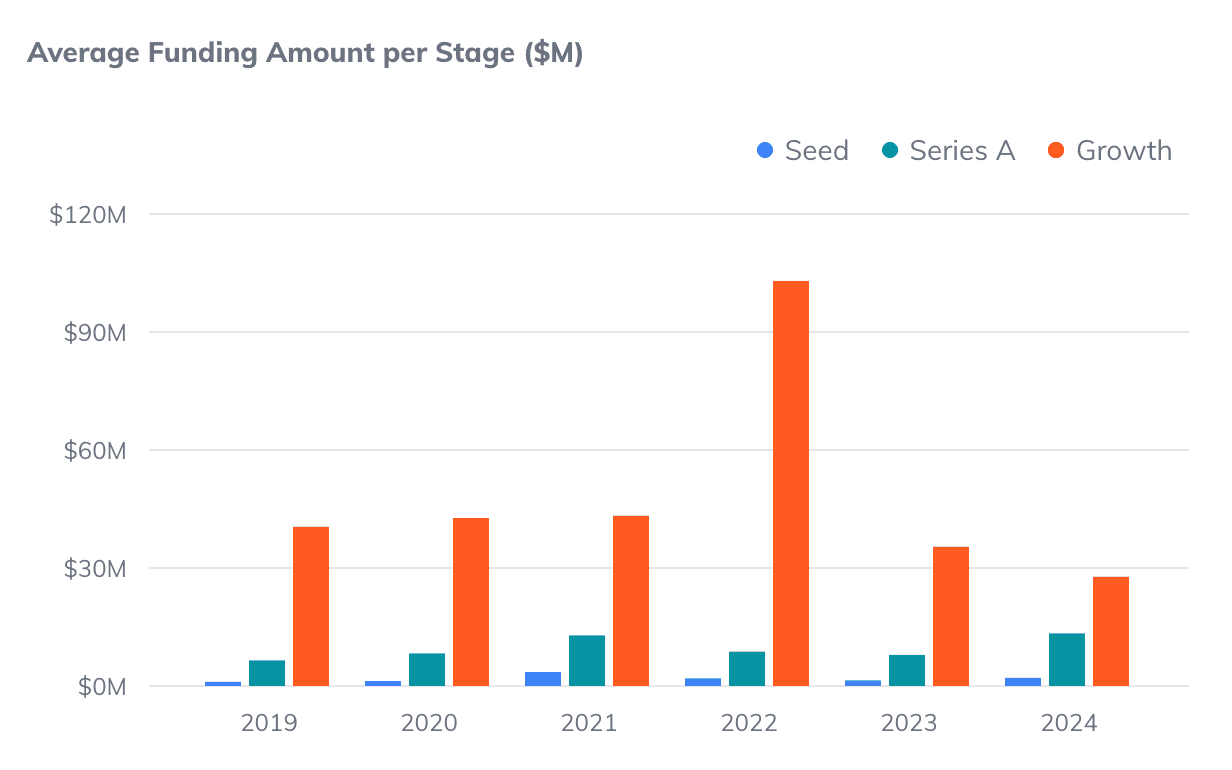

If we dig into the data, the difference in trajectory between total funding and number of rounds is partly attributed to the larger round sizes–a trend that follows the global market. The average Seed round size was $1.8M in 2019 versus $3.5M last year. For reference, the equivalent figure for US startups was $1.5M in 2019 and $4.5M last year.

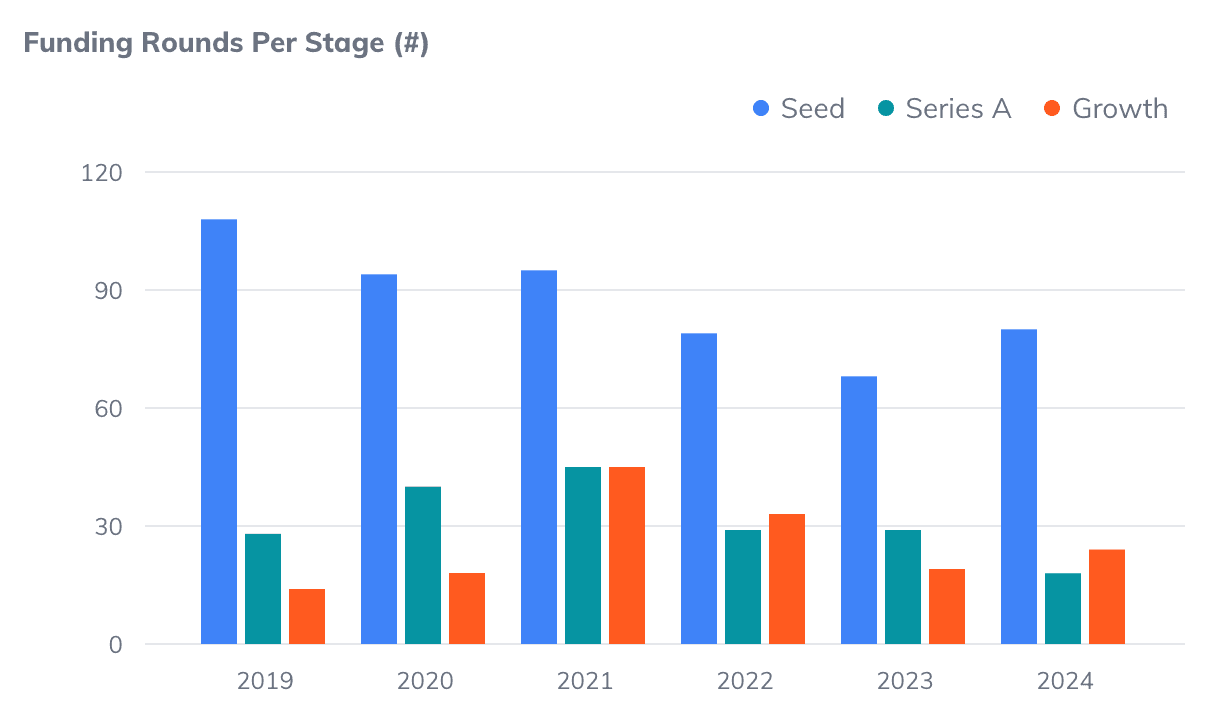

The distribution of these rounds per stage has also evolved. In particular, we saw more Growth (post Series A) rounds in 2024 (24) versus 14 rounds in 2019. On the contrary, last year, we had the least Series A rounds since 2019. This follows a global “Series A Crunch” trend, increasing concerns about the state of Series A fundraising following the exuberance of 2021 and 2022.

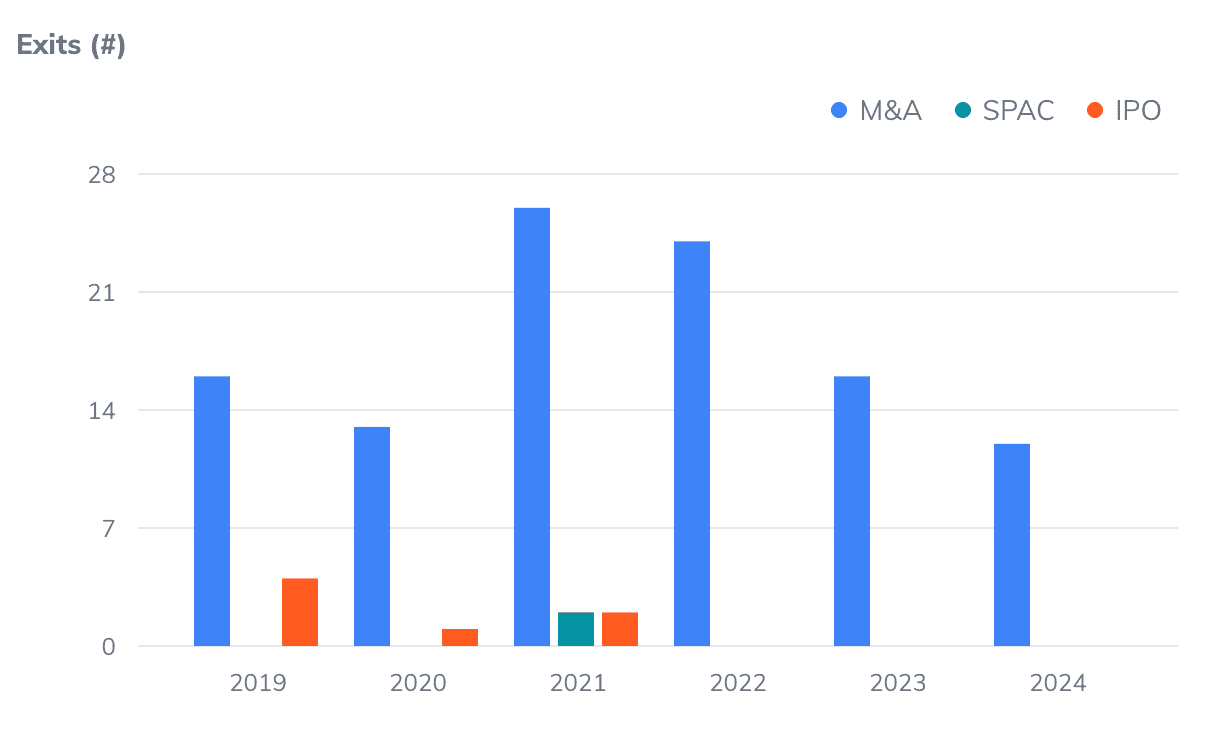

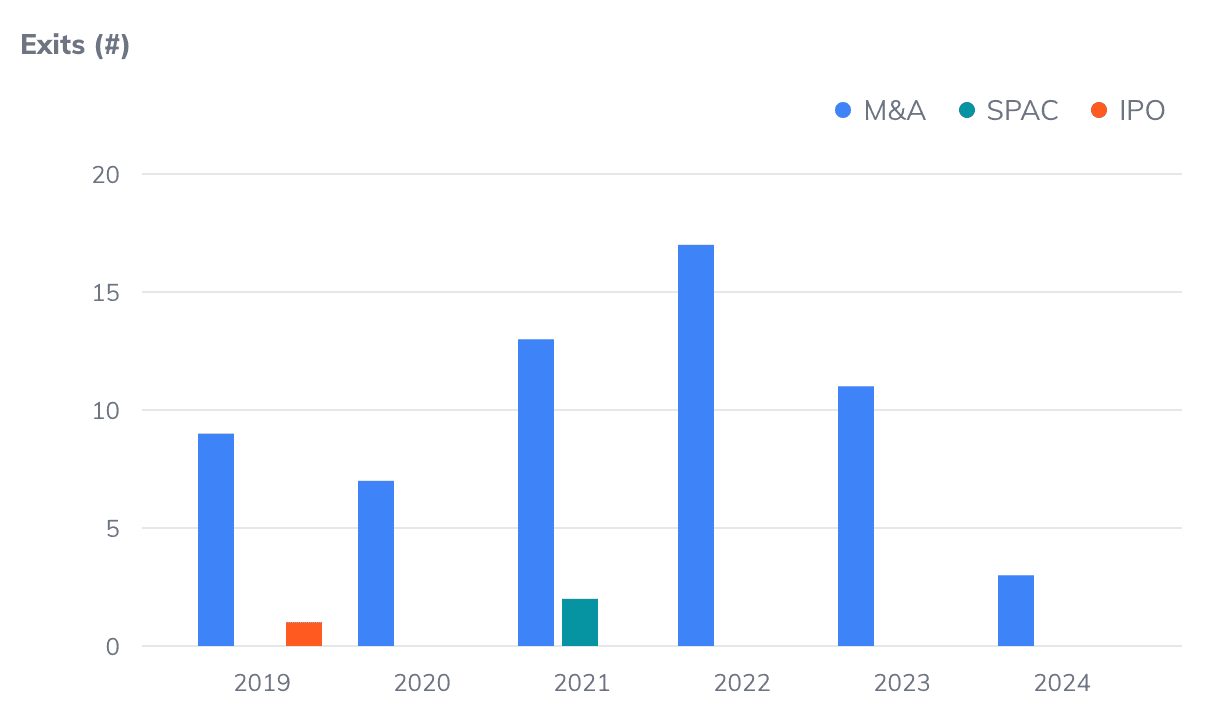

A dozen Greek-founded startups were acquired in 2024. Industry leaders continued to acquire startups in our market and integrate their technologies into their platforms. The figure was relatively lower compared to 2023 (12 versus 16), following a global slowdown in tech M&A. Some cases we saw in 2024, beyond BETA CAE, were the acquisitions of InAccel by Intel, Multi by OpenAI, Syft Analytics by Xero, and more.

Startups with operations in Greece

Zooming in on the startups maintaining operations in Greece, the total venture funding in 2024 ended up 32% higher than in 2023, reaching $400M. This presents a significant increase from the $250M total raised five years ago. About a third of these rounds related to AI companies, making artificial intelligence the leading sector for investments. Other prominent sectors included healthcare, fintech, climate tech, and more.

Startups in Greece raised around 60 financing rounds last year. The number has been rather flat since 2019, similar to how the equivalent figure for Greek-founded startups worldwide has evolved. We believe there is an opportunity for this figure to increase substantially going forward.

A difference between the startups maintaining operations in Greece compared to those in our sample that don't relates to the lower average round sizes. The average Seed and Growth round size of the former in 2024 was $2.1M and $27.8M, while the equivalent for the latter was $5.1M and $53.3M, respectively. This may also be attributed to the different levels of personnel costs, given that most non-GR startups have operations in tech hubs such as London, New York, San Francisco, etc.

Announced exits proved far fewer for startups with operations in Greece in 2024 compared to the year prior (3 versus 11). Nevertheless, 2024 saw the largest acquisition of a Greek tech company ever. BETA CAE, a bootstrapped simulation software company based in Thessaloniki, generating $90M in annual revenue by serving leading enterprise customers across automotive, aerospace, defence, and more, was acquired by Cadence (NASDAQ:CDNS), a global leader in electronic systems design for $1.24B. This is a pivotal moment for our industry and a testament to the growing ambition of Greek tech founders to build industry-defining companies.

For more information, please head over to our live dashboard Greek startups funding rounds & exits dashboard. Our inputs include a fusion of publicly available sources, such as Crunchbase and media publications. We acknowledge there may be several cases we did not manage to track and welcome further suggestions.

Taking a step back, it is fantastic to see how a small local community of founders and startup enthusiasts has matured over the years. Just a decade ago, when this industry was still in its infancy, few could imagine that today, it would consistently attract over $1B in new capital every year, with over 100 exits facilitated in the last five years.

We continue to be optimistic about the future outlook of our industry and believe we are just getting started. The cumulative experience and the growing ambition of thousands of startup builders across our global community serve as our greatest asset.

At Marathon, we have been on a mission to help Greek founders create world-class technology companies and cannot wait to see what our fellow Greeks in tech build next!