Greek Startups: Funding Rounds & Exits, 2023

2023 proved to be a year of contraction for the global venture capital industry. Leaving behind the impact of the pandemic and zero interest rates, the total amount invested in startups worldwide reached the lowest figure in the last six years. Healthy economics returned as a top priority, along with a smaller number of rounds, executed in sizes and valuations closer to historical averages.

As a market that experienced less hyperbole in the previous years, Greek tech demonstrated more resilience in 2023. The total funding amount raised by Greek-founded startups worldwide surpassed $1B, with top-tier investors leading rounds and supporting teams. Meanwhile, world-class companies and industry leaders continued to acquire Greek-founded startups and integrate their technologies into their platforms.

After years in the making, we believe we can safely claim that our industry has reached a considerable size, featuring several companies large enough to leave their mark in some of the most challenging problems out there!

Key Highlights

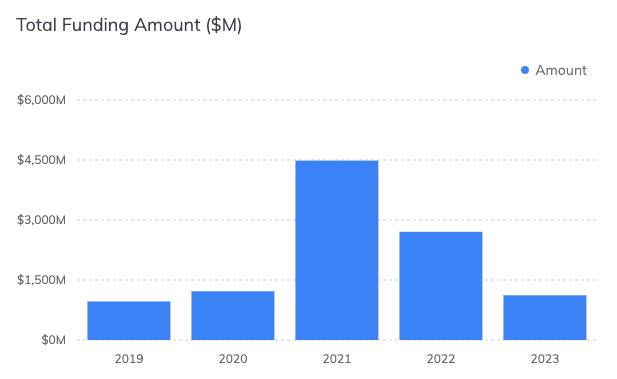

The total funding amount raised by Greek-founded startups worldwide in 2023 reached $1.1B. Despite the significant drop from the peak of euphoria a couple of years ago, the figure is still within its long-term trendlines. For reference, the equivalent was $962M in 2019 and $1.2B in 2020.

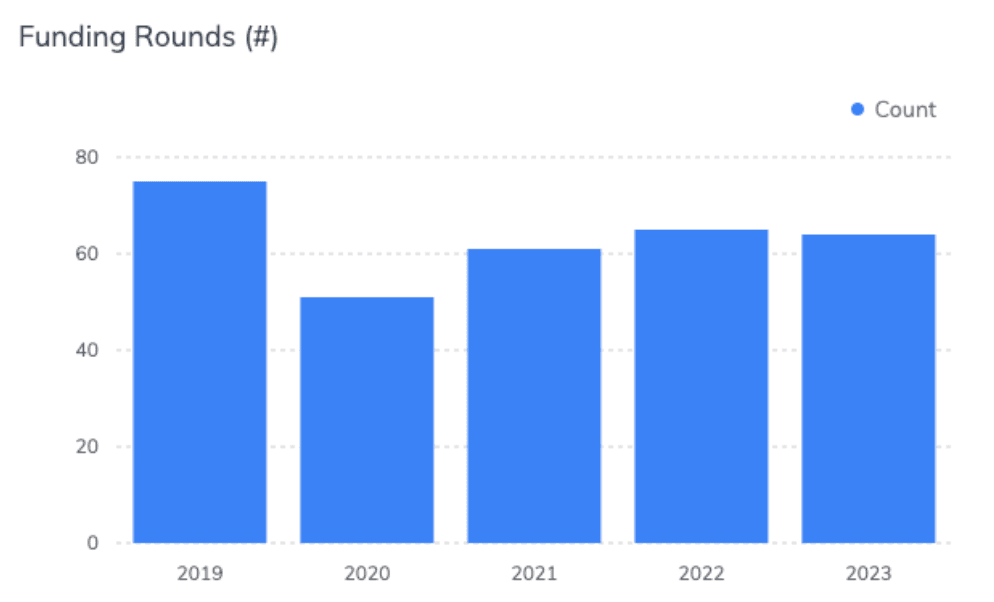

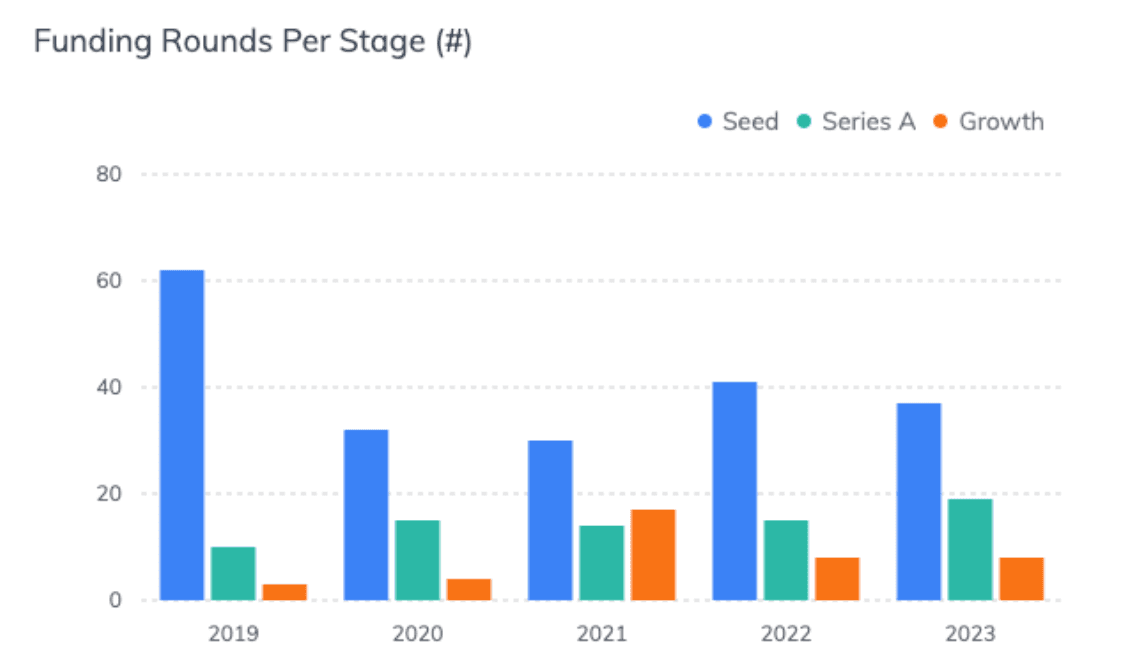

Zooming in on the startups maintaining operations in Greece, the number of rounds in 2023 ended at the same level (64 rounds) with 2022 (65) and 2021 (61). This is in contrast to other geographies, where activity diminished.

As a matter of fact, startups with operations in Greece experienced significant activity post Seed, with 27 rounds (Series A and Growth), while Series A reached its highest annual number to date (19 rounds). This is a testament to the growing cohort of startups in our market that are maturing and advancing their footprint at a larger scale, both locally and internationally.

Moreover, some of the most prominent investors globally continued to invest in Greek-founded startups last year, including Google and Nvidia (in Runway), Iconiq (in Causaly), Lightspeed and Coatue (in Endor Labs), Intel Capital (in TileDB), Carlyle (in Hack The Box), 83North (in Orbem), and others.

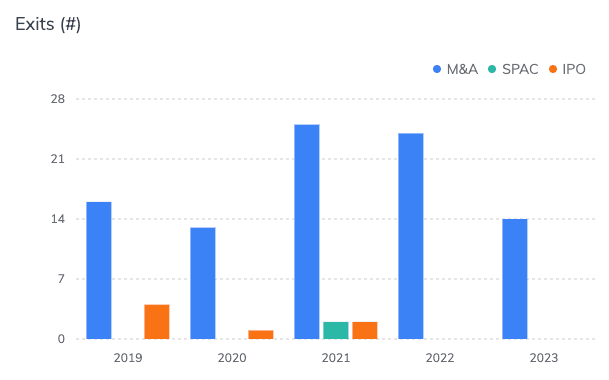

At the same time, the flywheel of our industry is alive and kicking! Some of the biggest names in the industry continued acquiring a number of companies, accelerating a virtuous cycle further and making startups the preferred career path.

Some of the cases we saw in 2023 were the acquisitions of Augmenta by CNH Industrial, Code BGP by Cisco, Marinetraffic by Kpler, DeepSea by Nabtesco, Arrikto by Hewlett Packard Enterprise, iSize by Sony Interactive Entertainment, and more.

For more information, head on over to our Greek startups funding rounds & exits dashboard to have a look. Our inputs include a fusion of publicly available sources, such as Crunchbase and media publications. We acknowledge there may be several cases we did not manage to track and welcome further suggestions.

Taking a step back, it is important to acknowledge how far we have come as an industry. What started as a small local community of founders and startup enthusiasts has matured into a market attracting $10B in 700+ rounds and more than 100 exits over the last five years.

More importantly, startup formation remains strong, and we continue to be optimistic about the future outlook of our industry – we actually believe we are just getting started. At Marathon, we have been on a mission to help Greek founders create world-class technology companies and cannot wait to see what our fellow Greeks in tech build next!