Norbloc and the fight against duplication

Last week Norbloc announced their $1.6 million seed round led by Marathon VC, with the participation ofDCG, Inbox Capital and Back In Black. We are thrilled to be working with Astyanax and Vitaliiand excited to be able to share some of our thinking here.

I am a big proponent of blockchain applications either in permissionless environments such as Bitcoin or permissioned ones. Many people advocate that permissionless innovation is what drives us forward and I totally agree. However, you shouldn’t forget that most public Blockchain projects are either not mature yet or the stakeholders in large enterprises still aren’t comfortable with them. More importantly, using a public decentralized ledger is a huge leap forward for processes that are still conducted in very inefficient ways, such as sending attachments via emails, faxes, filling forms, etc.

One of these mundane processes is KYC or Know Your Customer. This is the tedious and repetitive documentation procedure associated with opening a new bank account, brokerage account, sign up with a leasing company, etc. Financial institutions (FIs) have become the front line police of financial crime and customers, along with front desk officers, have to share or deal with the same mountain of documents again and again. This is a frequent and costly process. Financial regulation costs have exploded in the last years, especially after the Dodd/Frank Act and the imminent 4th EU directive against money laundering. This duplication of effort leads to a very poor customer experience and long onboarding times, hurting the bottom line of the businesses. Indicatively, in 2016, financial institutions spent 22% more time on KYC compared to 2015. What’s more, large customers need to update their documentation quarterly, leading to huge costs on both ends.

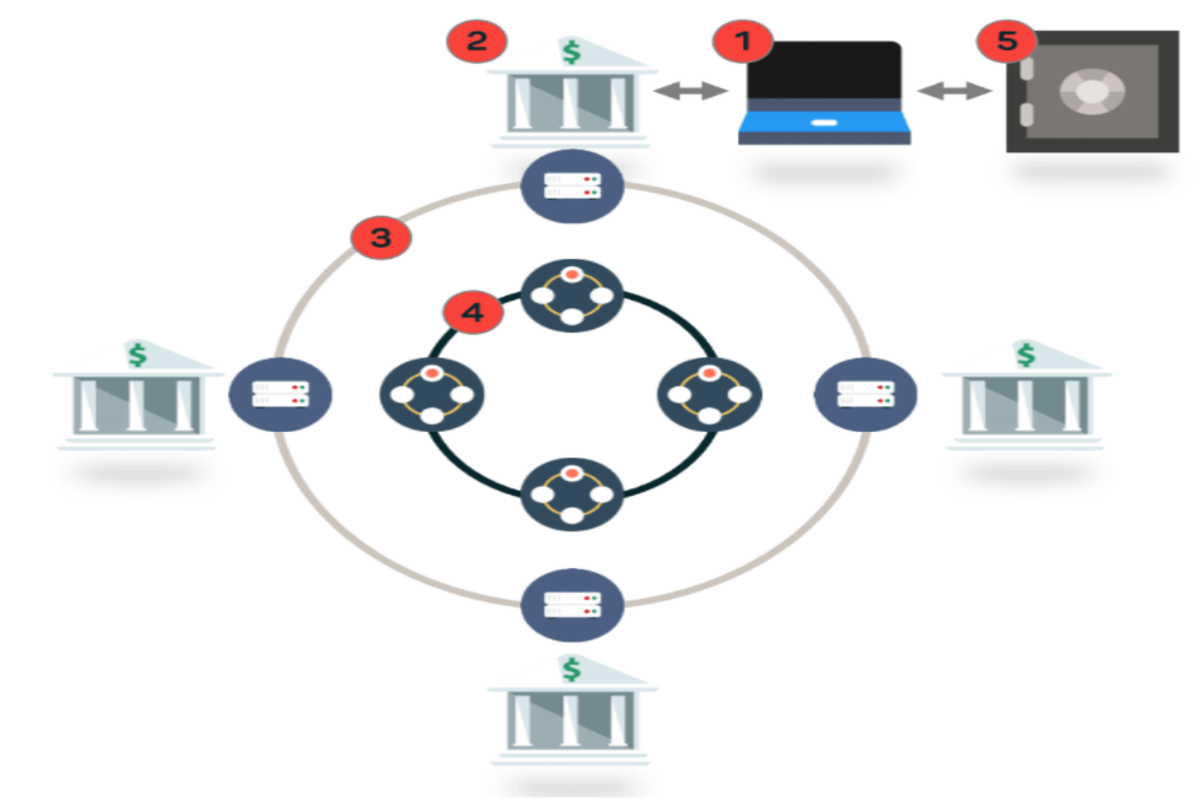

Norbloc solves this problem by creating a distributed record exchange utilizing blockchain technology, where one financial institution conducts the KYC process for a customer and gathers all relevant documentation. If the customer needs to go through KYC with another FI, the new institution can request the KYC docs from the original FI, after the customer has granted access. If any fields are out of date or missing, the front desk officer can ask the customer to fill in only these fields. The original FI can benefit by charging a fee for the documents and thus monetizing a traditional cost center. The receiving FI reduces the time and cost needed to onboard a customer, providing a better experience, while maintaining relevant metadata to ensure compliance with the overseeing regulator.

Norbloc has created a vertical application on top of a trusted blockchain. It incorporates data management, analytics, and workflows for customers, front desk office employees, compliance managers, and regulators. It makes life easier for everyone involved. We see the use of a private blockchain as a driver for the deflation of enterprise process costs (software & labor). In a traditional environment, FIs would need to create their own silos, build APIs that connect them with everyone or through a trusted 3rd party. With the use of the private blockchain, all this is thrown out of the window. Counterparties only agree on the protocol and the smart contract code that powers the exchange. FIs can now see who made the changes and view the data once a customer gives permission.

It is important to note that the customers have a central view of the authorizations they have given and can revoke them at any time. If a customer updates a data field associated with their account, all authorized parties will see the update. No need to login to several websites or send email, faxes and phone calls to simply have your address changes. Norbloc is already integrated with authentication systems such as BankID in Sweden.

We see a future where Norbloc could expand beyond KYC to Audit, Financial Control, Risk Management, Trade Lifecycle Management and Collateral Management. We think their commitment to empowering users with powerful management tools of personal data will become a foundation for others to build upon. We are thrilled to be along for the ride. Astyanax and Vitalii welcome to Km 1 of the Marathon!