Big Tech in Greece

Startups in Greece are an industry in the making. Previously, we have analyzed its driving forces, i.e., founders, capital, and companies. Several thousand people currently work for Greek startups, while tens of thousands are employed in the broader technology sector in the country. Still, there’s another part of the market which is similarly impactful, yet it has received less attention than it deserves.

Large enterprises maintaining a local presence stand as a core part of the market. They help to accelerate progress by raising the market’s profile, attracting talent and exposing it to big problems and world-class practices. People then often move on to help smaller companies grow fast, or start on their own, by leveraging their relevant experience and network.

A growing number of large technology companies –from infrastructure providers to household names– already have a presence in Greece, with more following suit. We believe it is important to highlight who they are and what they are working on. In this context, we made an effort to put together a comprehensive list. What follows is far from a complete directory; still, it provides an overview of the large technology corporates already participating in our local industry, which we hope you will find of interest.

From Daimler’s acquisition of Taxibeat to Oracle operating its cloud services to Apple running EMEA support to Tesla designing its electric motor, there already exists a number of Big Tech firms with an established presence in Greece, and the list is growing fast.

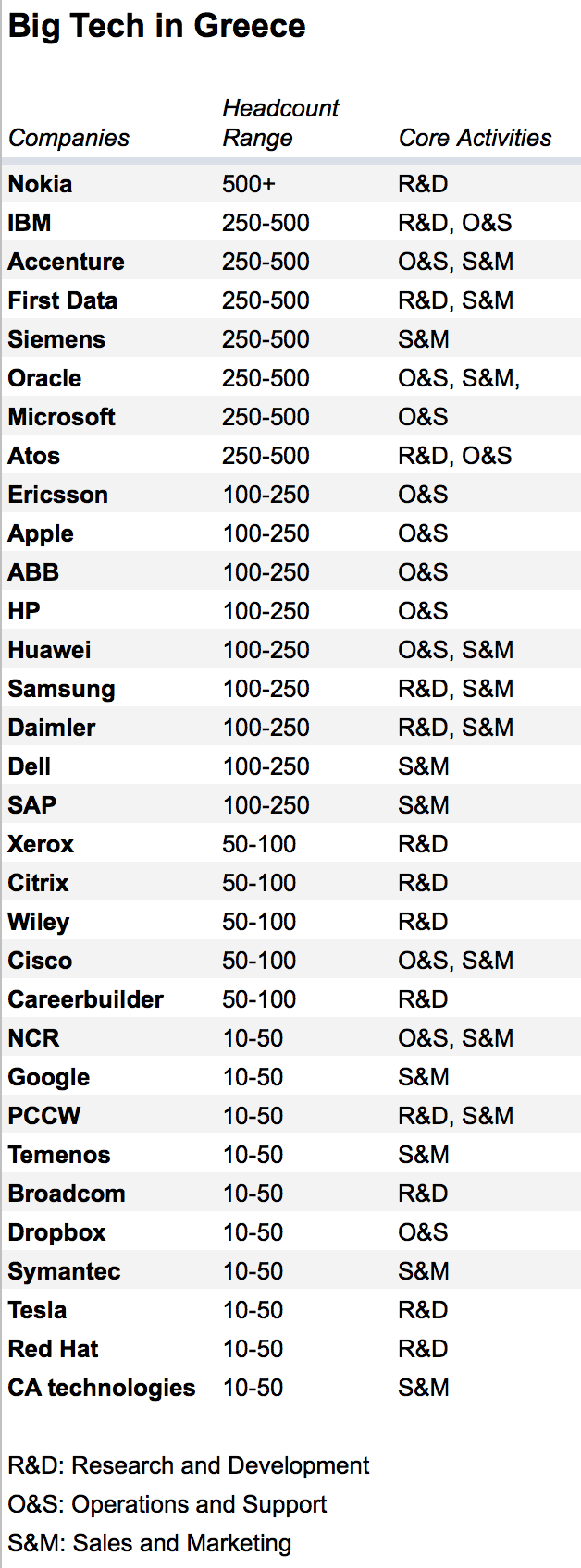

Our research identified 31 companies, employing more than five thousand people. The size of each outpost varies, from the dozen engineers of Red Hat to a workforce of a thousand people employed by Nokia. Such outposts are also supporting a diverse range of functions. The table below provides a summary of our findings; please note that figures are estimates.

Many of the above resulted from acquisitions of Greek technology companies. To name a few, Oracle acquired i-flex, which maintained a large presence in Greece. Samsung acquired Nanoradio, which continued an R&D center in Patras, and Innoetics, and is doubling down on local talent. Citrix acquired ByteMobile, now operating a significant outpost in Patras. U-blox acquired Antcor, and has tripled its local team since then; similarly for PCCW acquiring Crypteia Networks. A few years earlier, Broadcom acquired Athena Semiconductors. Last but not least, Daimler’s most successful acquisition in the mobile transportation space is Beat, which has taken over Latin America with its headquarters located in Athens.

Acquisitions are a trend that we expect to accelerate in the near future. At the same time, there is a growing interest from big tech companies to establish a presence in the country directly. An increasingly strong talent pool in a less competitive market provides for appealing opportunities that many want to explore.

A significant number of companies in the above list perform R&D in Greece, like IBM, Ericsson and Siemens. Others focus on Sales & Marketing, often covering the broader region from Greece, such as SAP, HP, and Dell. An increasing number of Big Tech run operations and technical support in Greece, including Apple, Microsoft, and Dropbox.

The skills acquired across these groups are crucial. Engineers working on state-of-the-art products, salespeople adopting best-in-class practices or successful technical support leads can make or break a young company. Next to founders and startup employees, as well as our Greeks in Tech peers from across the globe, the companies above add a much-needed piece of the puzzle, and their presence and expansion are great news for everyone in the market.

In cases like Israel, large enterprises helped built an ecosystem from scratch. In our case, Big Tech can help accelerate the Greek startup industry. As a matter of fact, it is already happening.